As the main region for the growth of the domestic steel industry, in recent months, the price of iron ore in Xinjiang has also been significantly reduced due to the combined decline in domestic steel prices and ore prices. On the one hand, Xinjiang steel enterprises lowered the purchasing price of fine iron powder because of the continuous drop in steel prices; on the other hand, Xinjiang's ore enterprises believe that there is still room for further increase in iron ore prices in the region and resist price cuts for fine iron powder. The reporter learned that in the near future, some Xinjiang miners have begun to reluctantly sell or stop supplying their products to steel mills. Although some suppliers are still supplying their products, the volume of supply has decreased significantly. The reluctance of the mining enterprises to requisition the steel mills caused difficulties in purchasing the goods, artificially triggering a contradiction between supply and demand.

Some Xinjiang mining companies reluctant to sell iron ore

Since 2012, due to the global economic downturn, China's iron and steel industry has not been able to operate with optimism. The domestic steel demand has been rapidly declining, steel prices have been significantly reduced, stocks have increased significantly, and the demand for iron ore by steel mills has also been further reduced. In response to the severe situation, major steel mills have reduced the purchase price of iron ore to reduce production costs. Especially since the beginning of this year, steel mills have lowered their prices continuously. The rapid decline and sharp drop in steel prices have had a great impact on the iron ore market, which has caused the enthusiasm of iron ore mining companies to suffer. To this end, mining companies have taken measures to reluctantly sell and suspend sales, some have slowed the rate of exploitation to drastically reduce the amount of exploitation, and some of the stockpiles of iron ore resources have been sold for sale, and some of the small election plants have been discontinued. At the same time, there are more and more harsh conditions imposed by the mining enterprises on the steel mills, such as the need to make prepayments before ordering.

Insiders pointed out that Xinjiang mining companies are reluctant to sell iron fines because they are expected and judged by rising iron ore prices in the region. They believe that the Xinjiang iron and steel industry has developed rapidly in the past two years. At the end of this year and the beginning of next year, four or five million-ton-scale steel projects will be completed and put into production. By that time, the demand for iron ore in Xinjiang will increase significantly. The supply of iron ore in Xinjiang is seriously lagging behind in the construction of mines and it is difficult to meet the demand of steel companies in the short term. Therefore, the price of iron ore is expected to rise.

Xinjiang Iron Ore Supply and Demand Particularity

According to industry analysts, in the next few years, there will be a partial phenomenon in Xinjiang where the contradiction between iron and steel concentrate supply and demand will intensify. As a result, the decline in iron ore prices will be smaller than the decline in steel prices, and the production costs of iron and steel enterprises will continue to be at a high level. Due to the shortage of resources, the price difference between Xinjiang's iron ore resources and the mainland will also become smaller and smaller, and the cost advantage of Xinjiang's iron ore resources relative to the mainland will gradually shrink. The main reasons are as follows:

First, in the past two years, Xinjiang's steel industry has developed rapidly, with nearly 10 million tons of steel production capacity rapidly expanding to a production capacity of nearly 40 million tons. According to the average iron content of 30% of the content calculation, coupled with metallurgical casting, etc., the amount of iron ore mining needs nearly 200 million tons, only this year, Xinjiang needs iron powder 20 million tons, and the current iron ore extraction in Xinjiang Only 30 million tons. The construction period of the steel plant is short. If the funds are sufficient, it is now more than two years to build a steel plant with several million tons at home; and the iron ore mine has a large investment, a long period, and a slow effect, from geological work to the production of finished products. It takes at least a decade and iron ore production is difficult to increase rapidly in the short term.

Second, the ecological environment in Xinjiang is fragile and the pressure for environmental protection in mining is increasing. Most of the iron ore resources in Xinjiang are in the West Tianshan, Kunlun Mountains, Altay and Altun Mountains. These areas are either in scenic areas or are very fragile in ecological environment, or in sensitive areas of ecological and military management as well as water sources, once destruction is difficult to recover. In recent days, Xinjiang has stepped up its efforts to control the indiscriminate mining of important minerals, and urged all localities to resolutely stop indiscriminate mining, unlicensed mining, wasting mineral resources and damaging the ecological environment; and resolutely close down and crack down on illegal mines, and stop all efforts. Mining of small iron ore, placer and placer gold ore. To this end, the Xinjiang Office of State Land and Resources issued the "Special Implementation Plan for Strictly Dealing with the Illegal Mining of Indiscriminate Mining and Unlicensed Exploitation," and clarified that special management work will be carried out from August to November. It is understood that since the second half of last year, only Qinghe County in Altay Prefecture has banned and halted 102 iron ore mines and reduced the supply of fine iron powder to more than 3 million tons.

Third, local protectionism has exacerbated the problem of unequal supply of iron ore resources in Xinjiang. Due to the uneven distribution of iron ore resources in Xinjiang, and the increasing efforts of local governments to attract investment, they have invested in the construction of steel projects, making the issue of resources more prominent. In order to meet the demand for new iron and steel projects in the region, almost all regions (prefectures) have issued a ban on the outflow of iron ore resources.

Steel companies take measures to protect iron ore resources

It is precisely the current uncertainties in the iron ore resource market in Xinjiang that some steel companies have begun to formulate long-term resource development plans to maximize their own interests. The first is to increase the renovation and renovation of old mines and accelerate the pace of new mine construction. At present, the tapping and transformation of some old mines has basically been completed, and the construction of new mines will also be put into operation within the next two or three years. By then, the supply and demand contradiction of Xinjiang iron ore is expected to be eased. The second is to increase the intensity of imported iron ore resources. After years of market cultivation, Xinjiang iron and steel enterprises have established stable iron ore supply channels with Central Asian countries and Mongolia, and the volume of imported fine iron ore pellets has reached more than 5 million tons annually. With the increase of railway transportation capacity and the deepening of work, the amount of imported resources will increase. Third, some iron and steel enterprises have signed “priority supply agreements for iron ore†with some mining companies in advance, or they have directly cooperated with the geological departments and local enterprises to mine iron ore by way of equity participation.

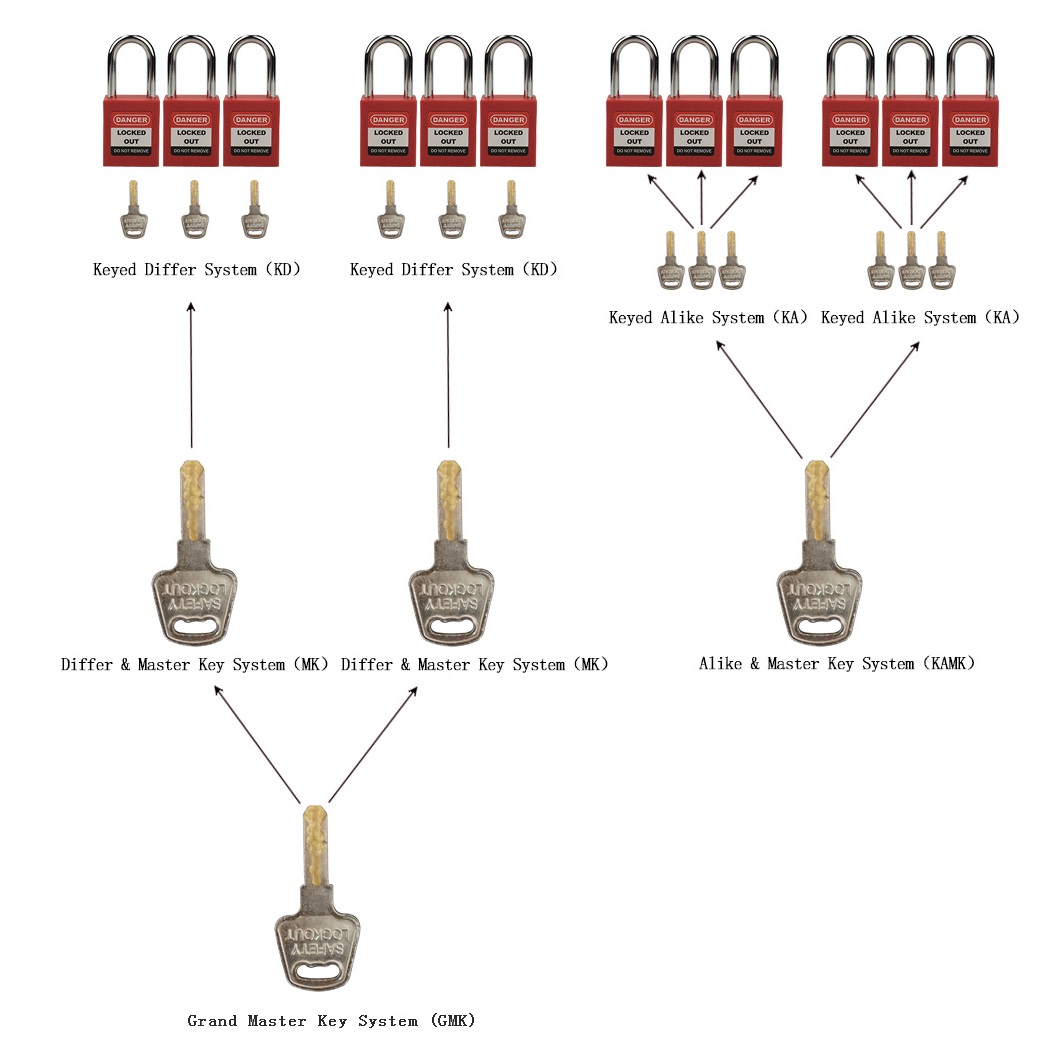

We supply Unique Key Charting System for keyed differently for you, OEM Manufacturing service is also available if required.

1. Keyed Differ System(KD): Each padlock is keyed differently, supplied with 2 keys per lock. 20000pcs individual padlocks available.

2. Keyed Alike System(KA): Each padlock is keyed the same. 1 key will open all padlocks in each group.

3. Differ & Master Key System(MK): Each padlock is keyed differently, supplied with 2 keys per lock. A master key will override and open any of these padlocks.

4. Alike & Master Key System(KAMK): Each padlock is keyed the same in one group. A master key will override and open all groups of Alike keyed.

Thermoplastic Padlock,Safety Lockout Padlocks,Security Padlock,Insulation Safety Padlock

Lockey Safety Products Co., Ltd. , http://www.lotolockey.com